Downtown

San Antonio

Alamo Heights/

Fort Sam Houston /

BAMC

San Antonio

Northeast /

Stone Oak

San Antonio

East Northeast/

Randolph AFB

San Antonio

Northwest /

Six Flags

San Antonio

West Northwest /

SeaWorld /

Lackland AFB

San Antonio

Alamo Corporate Housing

Thank you so very much.

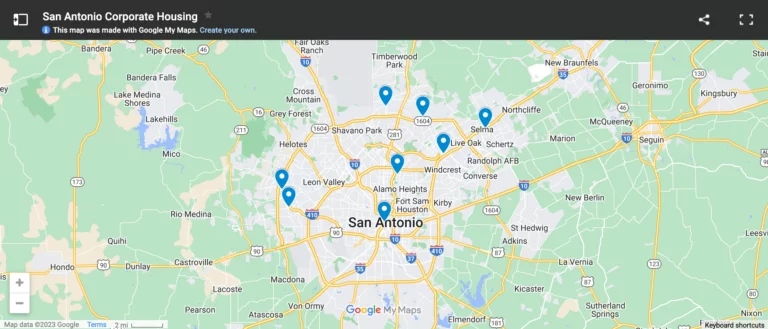

Corporate Housing in San Antonio, TX

Alamo Corporate Housing offers all-inclusive fully furnished apartments in San Antonio, TX, with 1, 2, and 3 bedrooms, including all utilities, digital cable, a flat-screen HDTV, and high-speed wireless Internet access.

Fully Furnished Apartments San Antonio

With properties across the city and Metropolitan area, Alamo has furnished locations near you, your employer or military station. Our San Antonio corporate apartments are in proximity to the most desirable shopping, dining, and transportation.

Amenities, Health & Fitness

Our San Antonio corporate housing rentals team goes above and beyond to guarantee your extended stay is furnished with all the comforts of home and the amenities that are important to you.

Corporate

Housing

Military/Federal Employee

Employee

Relocation

Insurance Relief Housing

Choose A San Antonio Location

We offer 1, 2, and 3 bedroom fully furnished and all-inclusive San Antonio corporate housing.

Texas Corporate Housing Locations

We also offer convenient Texas corporate housing locations throughout the South Texas greater metro areas including:

San Antonio, New Braunfels, Austin, and Corpus Christi.

This is a tooltip

1 of 1Why Alamo Corporate Housing?

As one of the best corporate housing companies in America, our luxury amenities, exceptional client service, and premier properties are perfect for individuals, military personnel, hybrid workers, and business travelers.

Corporate Housing FAQs

Everything You Need to Know About Corporate Furnished Housing in 2025

What is Corporate Housing?

How Much Does Corporate Housing Cost?

Cost of Corporate Housing vs Airbnb

What are Corporate Apartments?

What are the Benefits of Corporate Housing in 2025?

What's the Longest You Can Stay in an Airbnb vs Corporate Apt?

Apply Online Today

Let Us Help You Find The Perfect Housing Solution